LAW ON SOCIAL INSURANCE NO. 41/2024/QH15

On June 29, 2024, the National Assembly passed the Law on Social Insurance No. 41/2024/QH15 (“Law on Social Insurance 2024”), replacing Law No. 58/2014/QH13 dated November 20, 2014, and Resolution No. 93/2015/QH13 dated June 22, 2015 on the implementation of the lump-sum social insurance payment policy.

The Law on Social Insurance 2024 shall take effect from July 1, 2025, comprising 11 chapters and 141 articles (an increase of 2 chapters and 16 articles compared to the current Law on Social Insurance). With substantial amendments, the 2024 Law is designed to ensure social security in accordance with the Constitution; institutionalize the principles, directions, and reforms set forth in Resolution No. 28-NQ/TW and other relevant policy documents; fundamentally address practical issues and legal inadequacies; and expand coverage and enhance entitlements to attract greater participation in the social insurance system. Specifically, the 2024 Law on Social Insurance introduces the following 9 key changes.

1. Adjustment and expansion of the scope of participants subject to compulsory social insurance.

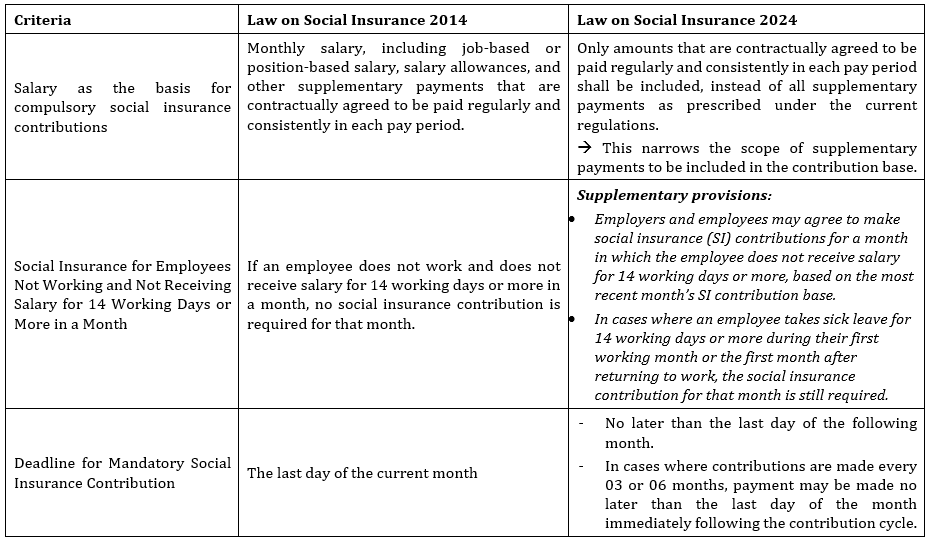

2. Changes to the minimum and maximum salary bases for compulsory social insurance contributions.

Under the 2024 Law on Social Insurance, the salary used as the basis for compulsory social insurance contributions shall be no lower than the reference salary and no higher than 20 times the reference salary at the time of contribution. The reference salary is an amount determined by the Government for the purpose of calculating social insurance contributions and benefits, replacing the previous provision under the 2014 Law, which set the minimum contribution base as the regional minimum wage and the maximum as 20 times the statutory base salary.

Accordingly, the 2024 Law on Social Insurance specifically defines the “reference amount” as a replacement for the “statutory base salary,” as follows:

- The reference amount is a monetary value determined by the Government, used as the basis for calculating contribution rates and benefit levels for certain social insurance schemes stipulated in this Law.

- The reference amount shall be adjusted based on the increase in the consumer price index (CPI), economic growth, and in accordance with the capacity of the state budget and the social insurance fund.

3. Changes in Social Insurance Contribution and Benefit Entitlements

4. Shortening the Timeframe for Initial Issuance of Social Insurance Books

According to the 2024 Law on Social Insurance, the social insurance authority shall issue the social insurance book for the first time within 05 working days (currently 20 days) from the date of receipt of a complete application. In case the book is not issued, a written response stating the reasons must be provided.

5. Introduction of Social Pension Allowance to Establish a Multi-tier Social Insurance System

- The social pension allowance, as stipulated in the 2024 Law on Social Insurance, is a form of social insurance guaranteed by the State budget. It is developed based on the inheritance and expansion of the current monthly social assistance scheme for elderly individuals who do not receive pensions or monthly social insurance benefits. Under the new regulation, the eligibility age for receiving the social pension allowance is reduced to 75 years old (previously 80 years old).

- In particular, individuals belonging to poor or near-poor households shall be entitled to the social pension allowance from the age of 70 to under 75.

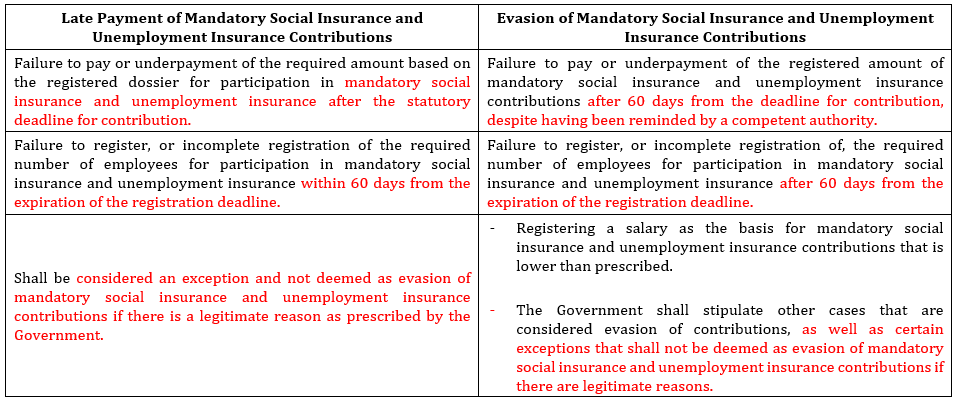

6. Specification of Measures for Handling Late or Evasive Payment of Mandatory Social Insurance and Unemployment Insurance Contributions

With the aim of strengthening the management of violations related to late or evasive payment of mandatory social insurance and unemployment insurance (UI) contributions, the 2024 Law on Social Insurance supplements provisions that provide a detailed explanation of such violations, specifically:

- At the same time, the 2024 Law on Social Insurance requires full payment of the late or evaded contribution amounts, along with a surcharge of 0.03% per day, calculated based on the unpaid amount and the number of days of late or evaded payment.

- In addition, violators shall be subject to administrative penalties or criminal prosecution (in cases of contribution evasion), and shall not be considered for awards, emulation titles, or commendations.

7. Reduction of Minimum Social Insurance Contribution Period for Pension Entitlement

The 2024 Law on Social Insurance reduces the minimum required period of social insurance contributions to 15 years for entitlement to monthly pension benefits, compared to 20 years under the 2014 Law on Social Insurance.

8. Adjustment to Lump-Sum Retirement Benefit Entitlement

9. Encouraging Employees to Preserve Contribution Periods for Pension Entitlement Instead of Receiving Lump-Sum Social Insurance Benefits

The 2024 Law on Social Insurance introduces multiple amendments and supplements aimed at enhancing benefits, increasing attractiveness, and encouraging employees to preserve their social insurance contribution periods to qualify for monthly pensions instead of opting for lump-sum social insurance benefits. Employees who have terminated their participation in social insurance may request to receive a lump-sum social insurance benefit if they fall under one of the following circumstances:

- Reaching the statutory retirement age but having less than 15 years of social insurance contributions;

- Emigrating abroad for permanent residence;

- Suffering from serious illnesses, such as cancer, paralysis, decompensated cirrhosis, advanced tuberculosis, or AIDS;

- Having a working capacity reduction of 81% or more, or being classified as a person with a particularly severe disability;

- Having contributed to social insurance before July 1, 2025, and after 12 consecutive months not being subject to mandatory social insurance and also not voluntarily participating, while the total contribution period is less than 20 years.

Employees who choose not to receive the lump-sum benefit and instead preserve their contribution period for future participation shall have the opportunity to enjoy more favorable entitlements, including:

- Higher benefit levels when resuming participation in the system;

- Easier eligibility conditions for receiving monthly pensions;

- Being entitled to health insurance contributions paid by the Social Insurance Fund during the pension benefit period;

- Eligibility to receive monthly allowance if they do not meet pension conditions and have not yet reached the age for receiving social retirement allowances;

- During the period of receiving monthly allowance, health insurance contributions will be paid by the State budget.