DECREE NO. 158/2025/ND-CP PROVIDING GUIDANCE ON THE LAW ON SOCIAL INSURANCE REGARDING COMPULSORY SOCIAL INSURANCE

On June 25, 2025, the Government issued Decree No. 158/2025/ND-CP providing guidance on the Law on Social Insurance regarding compulsory social insurance. This Decree takes effect from July 1, 2025.

It introduces several notable new provisions covering the scope of application, contribution responsibilities, and entitlement benefits — aimed at enhancing transparency, fairness, and alignment with the realities of current socio-economic development. Specifically, these include:

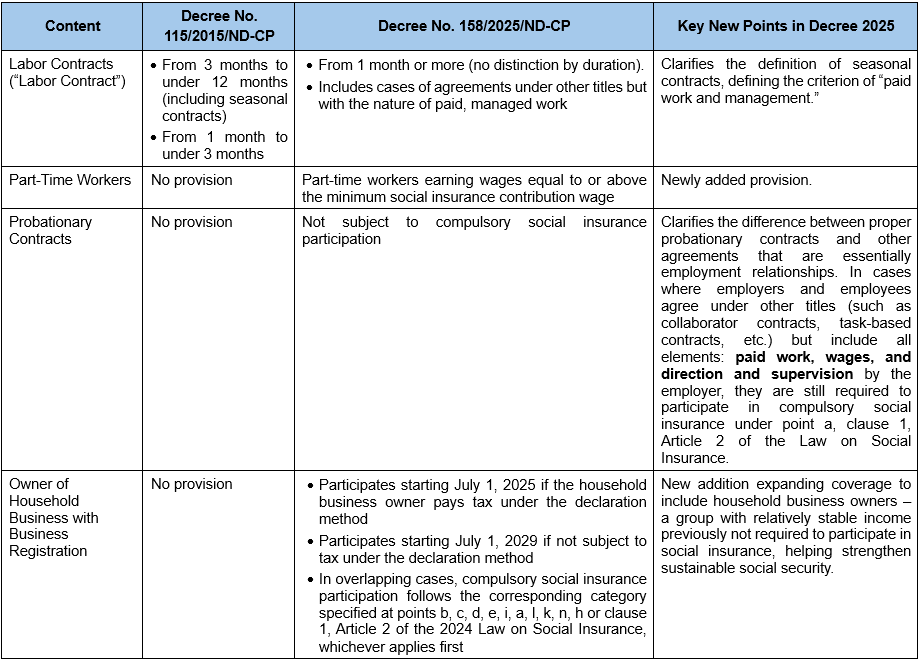

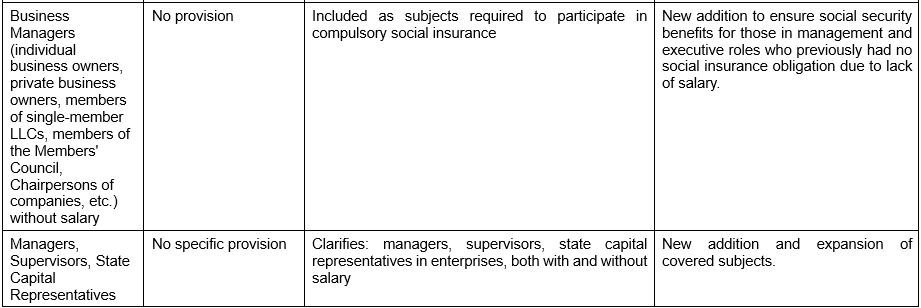

1. Participants in Compulsory Social Insurance

Differences in Participants in Compulsory Social Insurance Before and After July 1, 2025

2. Reference Level

The reference level is an amount determined by the Government used to calculate contribution levels and benefit levels for certain social insurance schemes specified in the Law on Social Insurance:

- Before the basic salary is abolished, the reference level is equal to the basic salary.

- When the basic salary is abolished, the reference level must not be lower than the basic salary at the time it was abolished.

The reference level will be adjusted by the Government based on: increases in the consumer price index, economic growth rate, and the capacity of the State Budget and the Social Insurance Fund.

Currently, the Government has not abolished the basic salary, so the reference level is equal to the current basic salary of VND 2,340,000 per month.

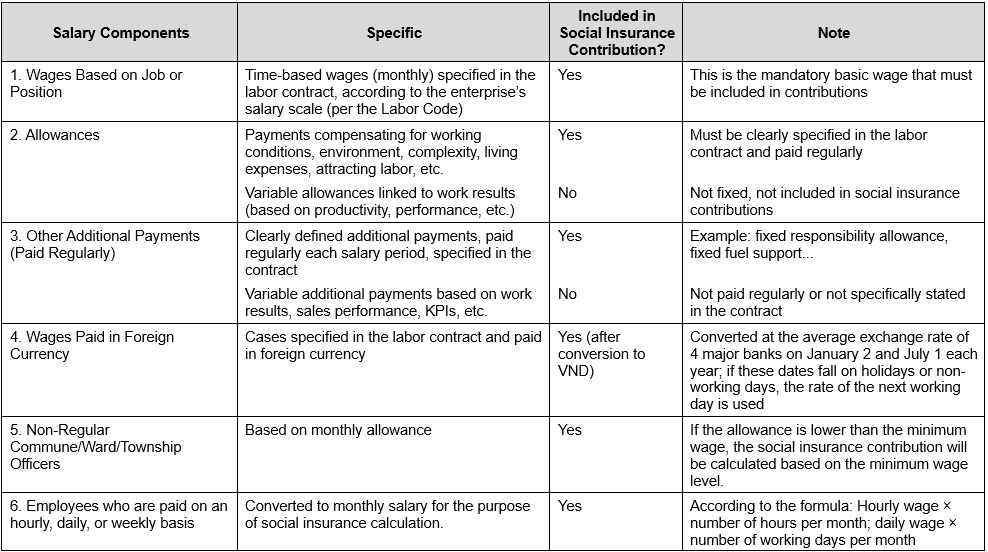

3. Wages as the Basis for Compulsory Social Insurance Contributions

According to Article 7 of Decree No. 158/2025/ND-CP, wages used as the basis for compulsory social insurance contributions include not only basic salary but also regular allowances and additional payments specified in the labor contract. This new regulation aims to ensure that social insurance contributions and benefits accurately reflect employees’ actual income, while fully protecting their entitlements to maternity, retirement, sickness, and other long-term benefits.

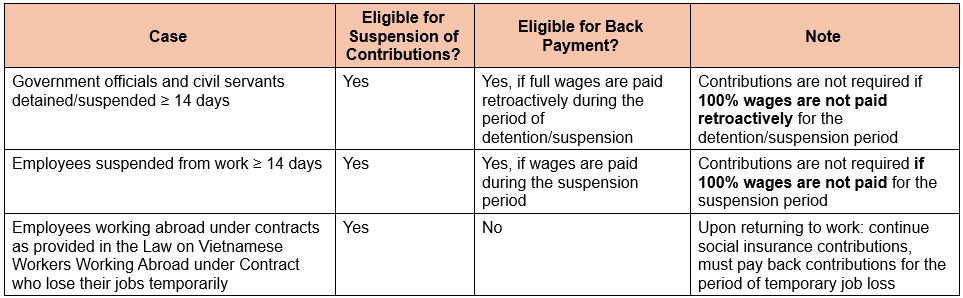

4. Temporary Suspension of Compulsory Social Insurance Contributions

This new provision clarifies the responsibilities and rights of the parties in temporary situations, while reducing the financial burden during periods when employees are suspended from work but have not yet received wages.

5. Adjustment of Regulations on Retroactive Collection and Payment of Compulsory Social Insurance Contributions

- Addition and Revision of Cases for Retroactive Collection and Payment of Social Insurance Contributions

- Retroactive collection when wage increases are applied retroactively as the basis for social insurance contribution.

- Addition of retroactive collection for household business owners and salaried business managers who fail to pay social insurance contributions after the latest permitted deadline.

(*) Previously, Decree No. 115/2015/ND-CP only referred to retroactive collection for increases in monthly wages already used for social insurance contributions.

- Shortening of the Deadline for Back Payment of Compulsory Social Insurance Contributions Without Late Payment Interest

- New deadline: Until the last day of the month following the month of the wage increase decision.

- Previously: Up to 6 months from the date of the wage adjustment decision.

- Retroactive Collection with Interest for Household Business Owners and Salaried Managers

- If payment is made after the latest permitted deadline, they must pay:

- The full amount of unpaid compulsory social insurance contributions;

- Late payment interest = 0.03%/day × unpaid social insurance amount × number of late days.

6. Retirement Benefits for Persons Paying Both Voluntary and Compulsory Social Insurance

6.1 Cases Prioritizing Compulsory Social Insurance:

- If they have at least 15 years (Article 64) or 20 years (Article 65) of compulsory social insurance contributions

👉 Apply retirement policy under compulsory social insurance.

6.2 Cases with 20 Years of Voluntary Social Insurance Before 01/01/2021:

If they participated in voluntary social insurance before 01/01/2021 and have at least 20 years of voluntary contributions

👉 Retirement age: 60 for men, 55 for women.